The goal of marketers is usually to increase revenue, so we create metrics that help us do that.

Metrics are those numbers that "per" -- like "cost per lead" and "page views per day."

Marketing Metrics Are Everywhere

There are metrics everywhere in the marketing/sales process from awareness to closing an order and servicing the customer.

We strive for increasing our clickthrough rate on e-mails, newsletters, banner ads, paid search ads, and wherever we can measure clicks.

We look for ways to increase the "open rate" for everything from e-mails and envelopes to prospects' minds.

Why? Because these metrics are highly correlated to revenue, which is what we've all been taught is our goal.

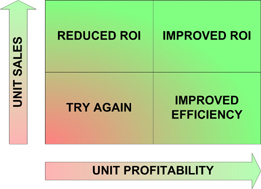

Keeping Marketing Metrics Profitable

However, there are times when increased sales causes decreased profits.

This can happen when marketers are successful in getting customers to buy a "loss-leader" product. This type of product is sometimes added to the product line for a strategic reason, such as to show the market that the company is a one-stop place to buy that category of products.

Another type of problem product is one that is profitable but not as profitable as similar products sold by the company. These sometimes start out as custom products made for a special customer, then they're added to the catalog because someone says, "We've already got the molds and jigs."

No matter how these products found their way into the product line, they can cause profit problems when marketing (and sales) succeeds at increasing revenue to improve their metrics.

While increasing revenue is good, increasing profits is better because that increases shareholder value. So, be sure the products you're promoting are profitable or support a non-financial marketing strategy.